Which Renovation Loan Is Right for You? A Guide to Financing Your Fixer-Upper

Finding the perfect home in today’s market can be a challenge. Sometimes, the house with the perfect location in Fredericksburg, TX, or the ideal layout doesn’t quite match your aesthetic vision. Or perhaps you are eyeing a historic property in the Texas Hill Country that needs a little TLC to restore its former glory.

Instead of walking away from a “fixer-upper,” you can turn it into your dream home with the right financing. This is where home renovation lending comes into play.

At Vickie Lasher Mortgage Solutions, we specialize in helping homebuyers and homeowners across 22 states—including right here in Fredericksburg—navigate the complex world of renovation finance. But with options like the FHA 203(k), Fannie Mae HomeStyle, and VA Renovation loans, how do you know which one is right for you? Let’s dive in.

What Is a Renovation Loan?

A renovation loan is a single mortgage that allows you to borrow money for both the purchase of a home and the cost of the repairs or upgrades. Instead of taking out a mortgage to buy the house and then scrambling for high-interest personal loans or credit cards to fix it up, you wrap everything into one monthly payment with one interest rate.

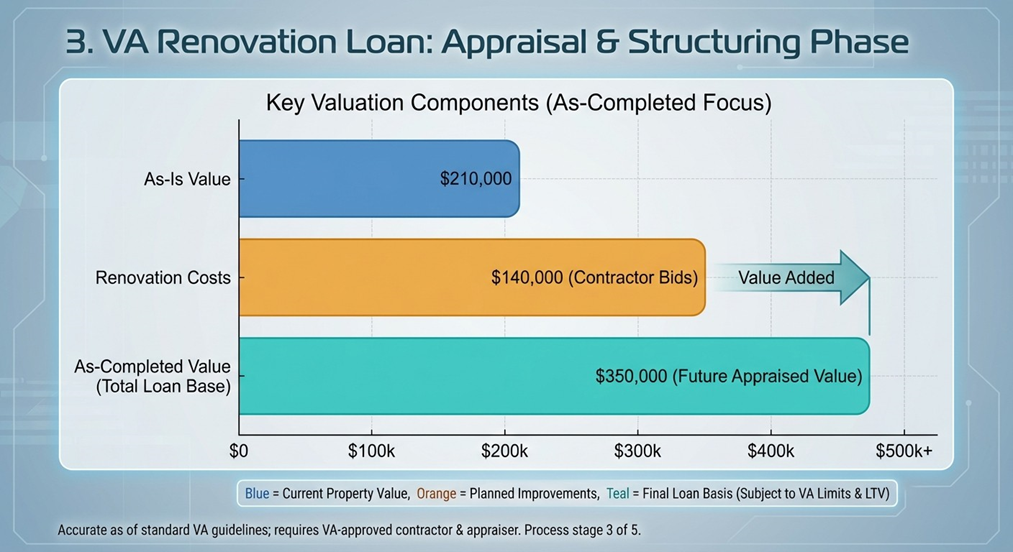

These loans are based on the “as-completed” value of the home—what the house will be worth after the renovations are done. This gives you significantly more borrowing power than a standard loan.

Whether you are a first-time homebuyer looking for an affordable entry point into the market or a current homeowner looking to remodel, there is likely a program that fits your needs.

The Top 3 Renovation Loan Options

To determine which loan fits your scenario, we need to look at your credit profile, the type of renovations you want to do, and your down payment capabilities. Here are the three most popular options we offer.

1. FHA 203(k) Renovation Loan

The Federal Housing Administration (FHA) backs this loan, making it one of the most accessible options for buyers with lower credit scores or smaller down payments. It is an excellent choice for those looking into FHA loans who want to buy a property that might not currently pass a standard inspection.

There are two types of FHA 203(k) loans:

- Limited 203(k): Designed for minor remodeling and non-structural repairs. The renovation costs are capped (usually at $35,000). This is perfect for updating a kitchen, replacing appliances, or painting.

- Standard 203(k): Used for major structural repairs. If you need to move walls, add a room, or fix a foundation, this is the route to take. It requires a HUD consultant to oversee the project.

Best For: Buyers with credit scores as low as 580 (sometimes lower depending on circumstances) and those who can only afford a low down payment (3.5%).

2. Fannie Mae HomeStyle® Renovation Loan

The HomeStyle loan is a conventional loan product. It is generally more flexible regarding the types of renovations allowed compared to the FHA 203(k). For example, while FHA loans require the improvements to be “necessary” or add value in a specific way, HomeStyle loans allow for “luxury” items.

Do you want to add a swimming pool to your backyard in Fredericksburg to beat the Texas heat? You can do that with a HomeStyle loan. You can also build an accessory dwelling unit (ADU) or do extensive landscaping.

Best For: Borrowers with higher credit scores (typically 620+) who want to finance luxury improvements or investors looking to renovate rental properties.

3. VA Renovation Loan

For our service members and veterans, the VA Renovation loan is an incredible tool. As experts in VA loans, we are proud to offer this product. It allows you to purchase a home and include money for repairs with $0 down payment.

While slightly more restrictive on the types of repairs (generally no luxury items like pools), it offers some of the best interest rates and terms available on the market. It is perfect for buying a home that needs cosmetic updates or minor structural work to meet VA minimum property requirements.

Best For: Veterans and active-duty military members who want to buy a fixer-upper with no money down.

Comparison: Which Loan Fits Your Project?

To help you visualize the differences, we’ve broken down the key features of these loan programs in the table below.

Feature FHA 203(k) Fannie Mae HomeStyle VA Renovation Min. Down Payment 3.5% 3% – 5% 0% Min. Credit Score Typically 580 Typically 620 Typically 620 (flexible) Luxury Items (Pools, etc.) No Yes No Occupancy Primary Residence Only Primary, Second Home, or Investment Primary Residence Only Consultant Required? Yes (for Standard) Sometimes (depending on scope) Usually Yes

Why Choose a Renovation Loan in Fredericksburg, TX?

Living in Fredericksburg, TX, we are surrounded by beautiful history. From classic Sunday Houses to ranch-style homes on acreage, the inventory here is unique. However, older homes often require updates to modern electrical systems, plumbing, or simply a cosmetic refresh to match today’s design trends.

By utilizing Vickie Lasher Mortgage Solutions for your renovation financing, you gain a local partner who understands the nuances of the Hill Country market. Whether you are looking to renovate a property near Main Street or expand a home in the surrounding counties, we can guide you through the local appraisal and contractor requirements.

Not in Texas? No problem. We are licensed in all 50 states and actively serve clients in Arizona, Florida, Colorado, Tennessee, and beyond. Our mortgage experience spans across the country, ensuring you get expert advice regardless of your location.

The Renovation Loan Process: Step-by-Step

Many buyers are intimidated by renovation loans because they fear the paperwork. While there are more moving parts than a standard fixed-rate mortgage, we guide you every step of the way.

- Pre-Approval: We analyze your income, credit, and assets to determine your budget.

- Find a Home & Contractor: You find the house and a licensed contractor to provide a detailed bid for the work.

- Appraisal: An appraiser determines the value of the home after the renovations are completed.

- Loan Approval & Closing: We finalize the loan. You buy the house, and the renovation funds are placed in an escrow account.

- Renovation Begins: Your contractor starts working. Funds are released in “draws” as work is completed and inspected.

- Move In / Completion: Once the work is done and the final inspection is passed, you enjoy your new home!

If you already own your home and want to renovate, you can also use mortgage refinancing to switch into a renovation loan, using your equity to pay for the improvements.

Frequently Asked Questions (FAQs)

1. Can I do the renovations myself to save money?

No. A contractor is required. Call to discuss self-help options.

2. What happens if the renovations cost more than expected?

Renovation loans typically include a “contingency reserve” (usually 10-20% of the renovation budget). This money is set aside to cover unforeseen costs, such as finding mold behind a wall or needing to upgrade wiring. If you don’t use it, the funds can be applied to your principal balance.

3. Can I use a renovation loan for an investment property?

Yes, but only with the Fannie Mae HomeStyle loan. The FHA 203(k) and VA renovation loans are strictly for primary residences. If you are an investor looking for flip potential or rental upgrades, ask us about our investment-specific options or hard money lending solutions.

4. Are the interest rates higher on renovation loans?

Interest rates for renovation loans can be slightly higher than standard purchase loans because they carry a bit more risk and administrative work for the lender. However, because you are financing the repairs over 30 years, the monthly payment is often much lower than using

high-interest credit cards or personal loans.

5. How do I choose a contractor?

You should choose a contractor who is licensed, insured, and ideally experienced with renovation loans. They need to be willing to wait for payment through the bank’s “draw” schedule rather than asking for all the money upfront. We can provide you with tips on what to ask potential contractors.

Ready to Build Your Dream Home?

Don’t let a “fixer-upper” label scare you away from a great home. With the right renovation loan, you can customize a property to meet your exact needs and build instant equity.

Whether you are in Fredericksburg, TX, or anywhere across the U.S., Vickie Lasher Mortgage Solutions is here to help you structure the perfect loan. With over 25 years of experience, Vickie and her team make the complex simple.