Why The Hell Do You Need That?

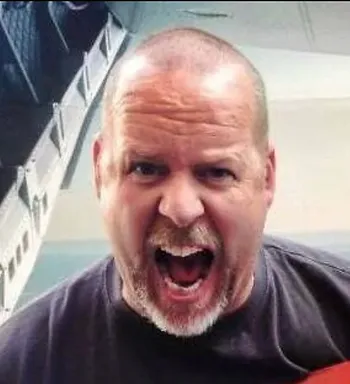

Why the hell do you need THAT!

If you have bought a house in the past you know you’ve said this before. If you have never bought a house but you are going to, you will say this. It seems to be the rallying cry every buyer screams before the closing on their new home. The Mortgage Lender will ask for normal items that are obvious like, Paystubs, Tax Returns and Bank Statements. Then as the days approach your closing date on the house they start asking for items that just seem downright ridiculous. This is to explain why.

You have worked hard for many years. You pay your bills on time and manage to even save a little money. What a great grown-up you have been! There should have a parade in your honor for the sacrifices you have made to obtain your good credit status. Meanwhile your friends have been boozing it up on 6thstreet for years. They drive around in a beautiful sports car while you rock that ten year old used Honda with a small exhaust problem. They seem to be living life to the fullest and you are at home with Netflix and a bowl of Cheetos. Fear Not! You have made the right decision. See, while your friends park that shiny car at their apartment where their neighbors play loud music all night and the sounds of toilets flushing from the guy above them rumble down the pipes at 4am every morning, you will be the owner of an actual home with privacy and equity. Good trade off.

So you gather up all the financial documentation your Lender asked for, get prequalified, and head out to find your new home. Once the negotiating is done and you are now under contract you will face a dozen more phone calls from your Lender. Now they want updated paystubs, bank statements, and letters of explanation for every inquiry on your credit report. Why were you 30 days late 4 years ago on your credit card? Who pulled your credit two months ago and why? The list seems to go on and on.

When you have given everything you thought possible to the Lender you may get even more requests. Now they are asking about deductions on your paystub or what kind of dog you have (really). Your frustration is starting to go through the roof but you comply. Then one night, just as you are finishing up binge watching The Vampire Diaries, your phone rings. It’s your Lender wanting to know where the large deposit on your bank statement came from last month. You gasp in frustration and start dropping the F-Bomb as you try to explain you moved money from your savings account to cover the closing costs on the loan. Before stabbing your Lender in the neck with a salad fork, you opt for panting like a madman and scream WHY into the phone.

Well here is the answer but you aren’t going to like it. You are getting a home loan. Seriously, that is the answer. Remember, you are asking a bank to front you a few hundred thousand dollars based on your history of being a grown up and paying your bills on time. The bank uses the Lender to gather up your information who then hands it over to an Underwriter. An Underwriter’s job is to ensure that if something horrible happens and you can no longer make your house payment, the bank will be covered under their Mortgage Insurance policy. It is the ultimate cover-your-ass situation.

You would lose your home but the bank could lose the hundreds of thousands of dollars they invested in you. Ever gone to your car insurance and asked for them to cover an accident? Getting them to pay can be like pulling teeth. Getting an insurance company to pay a mortgage is like trying to pull teeth from a lion who hasn’t been tranquilized first. They will comb through every item in your file in order to put it back on that pesky Underwriter who signed off the approval of the loan. The Underwriters track record is followed as well. The pressure that Underwriter has is enormous.

Of course the loopholes grow exponentially with things like Gifts for the down payments, credit issues, ratio’s going over the suggested percentage, job changes, moving money in and out of your bank accounts during the loan process, etc… Hundreds of factors come into play and it all boils down to the bank ensuring it is covered if anything bad happens. You would be extra careful too if you were that bank that had millions of dollars on the line. This may not ease your frustration during the very emotional home buying process but it should make it a little clearer as to why the Lender is pestering you during The Vampire Diaries.

EMAIL ME WITH ANY QUESTIONS! vlasher@annie-mac.com